These charges are over and above the interest charges for converting the purchase into EMIs

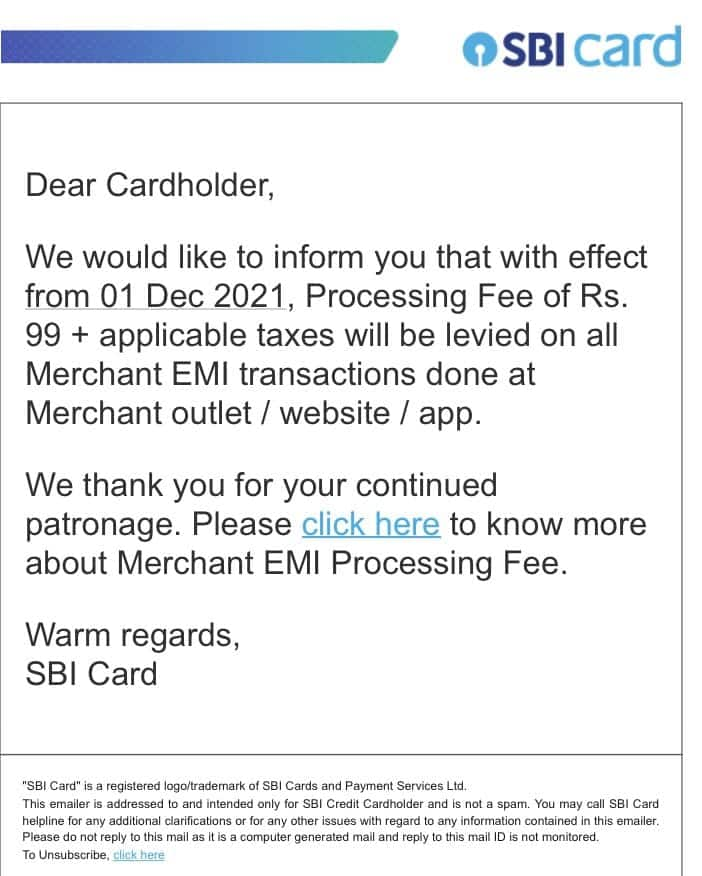

Effective from December 1, 2021 SBI Cards & Payment Services Private Limited (SBICPSL) will charge flat processing fees of Rs 99 plus taxes on all equated monthly instalment (EMI) transactions. The company will charge the processing fees for all EMI transactions done at retail outlets and e-commerce websites such as Amazon and Flipkart. These charges are over and above the interest charges for converting the purchase into EMIs. The company informed its customers about the new charge by email (refer to image).

Processing charges

The processing charges apply to transactions successfully converted into EMIs. Any transaction done before December 1, with the EMI booking occurring after December 1, will be exempted from this processing fee. The company will intimate the applicability of the processing fees on EMI transactions to cardholders via charge slips while shopping at retail outlets. For online EMI transactions, it will intimate processing charges on the payment page. The processing fees will be reversed in case the EMI transaction gets canceled. However, the same will not be reversed in the case of pre-closure. Reward points will not apply for transactions converted into merchant EMIs.

A retail banker requesting anonymity says, “These processing charges from SBICPSL are as per industry standards. Other leading private banks have been charging these fees for a long time.”

Assume you buy some consumer electronics using SBI credit card from one of the e-commerce websites under its EMI scheme. Then SBICPSL charges you Rs 99 as processing fees plus applicable taxes. This will be reflected in your monthly credit card statement along with the EMI amount.With processing fees being introduced on credit cards for converting the transactions into instalments, ‘Buy Now, Pay Later’ schemes may be affected as they will become expensive.